Condo Insurance in and around Lisle

Get your Lisle condo insured right here!

Cover your home, wisely

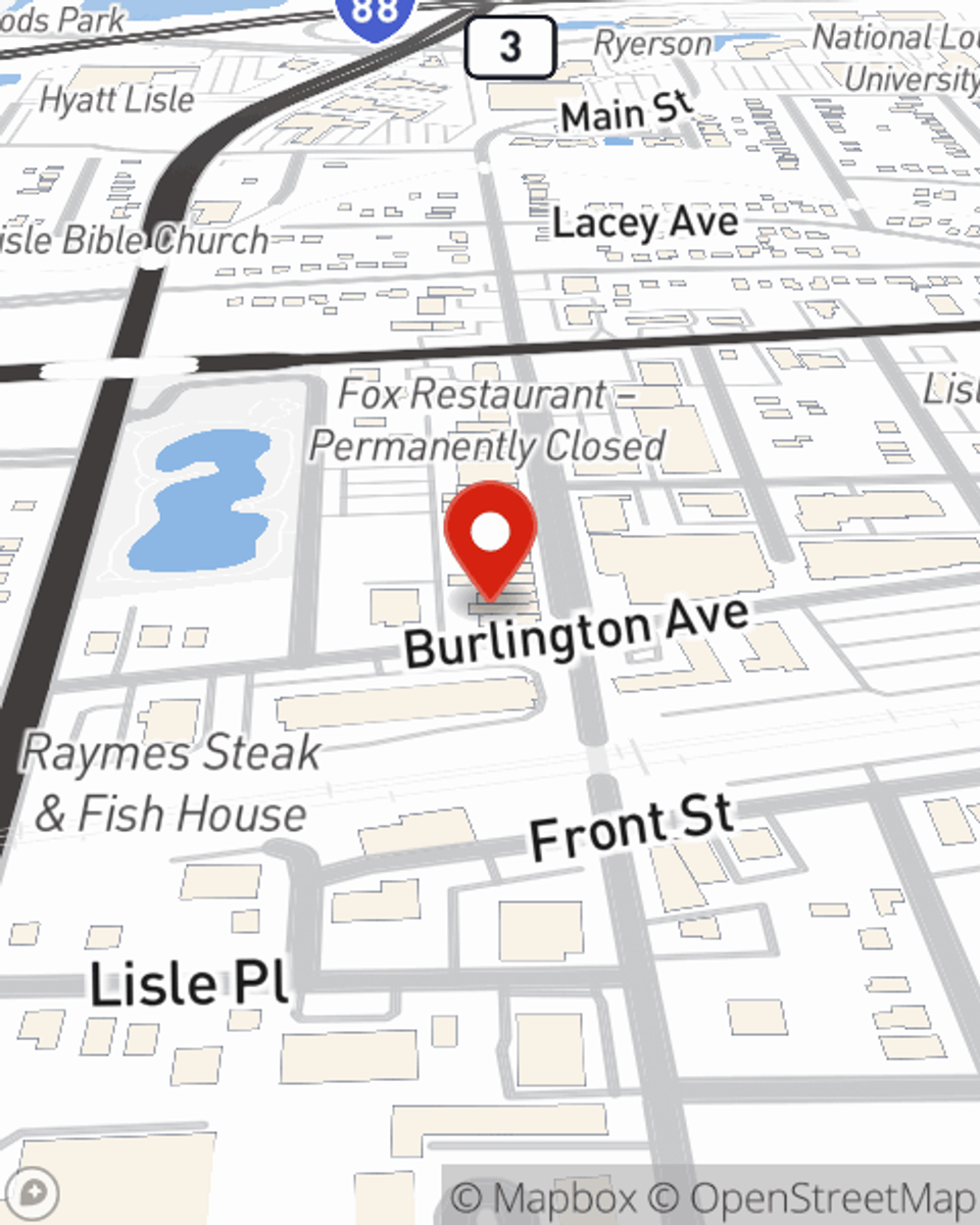

- Lisle

- Downers Grove

- Woodridge

- Lombard

- Naperville

- Glen Ellyn

- Wheaton

- Westmont

- Warrenville

- Villa Park

- Oak Brook

- Bolingbrook

- Plainfield

- Oakbrook Terrace

- Dupage County

There’s No Place Like Home

No matter your level of preparedness, the unexpected can happen. So be the condo owner who is prepared with quality insurance which may be able to help in the event of damage from theft, weight of ice, or lightning.

Get your Lisle condo insured right here!

Cover your home, wisely

Agent Todd Macdonald, At Your Service

With State Farm Condominium Unitowners Insurance, you can be assured that you property is covered! State Farm Agent Todd MacDonald is ready to help you navigate life’s troubles with reliable coverage for all your condo insurance needs. Such attentive service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If you have problems at home, Todd MacDonald can help you submit your claim. Keep your condo sweet condo with State Farm!

Reach out to State Farm Agent Todd MacDonald today to see how a State Farm policy can help protect your condo here in Lisle, IL.

Have More Questions About Condo Unitowners Insurance?

Call Todd at (630) 964-1913 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Todd MacDonald

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.